Bookkeeping

Generally Accepted Accounting Principles GAAP: Definition and Rules

They are particularly useful for visualizing how transactions impact specific accounts and are often used for teaching and understanding the double-entry system. In the double entry system, each financial transaction is recorded using a dual-entry mechanism, involving both debits and credits. These terms are not related to banking activities 990-finder but rather represent the two sides of every transaction. Even with GAAP’s transparency rules, financial statements can still contain errors or misleading information. Always scrutinize financial statements, as there’s potential for manipulation within GAAP’s framework. Any person or party involved in, or responsible for, the financial side of a business must be honest in all reports and transactions.

Financial Statements

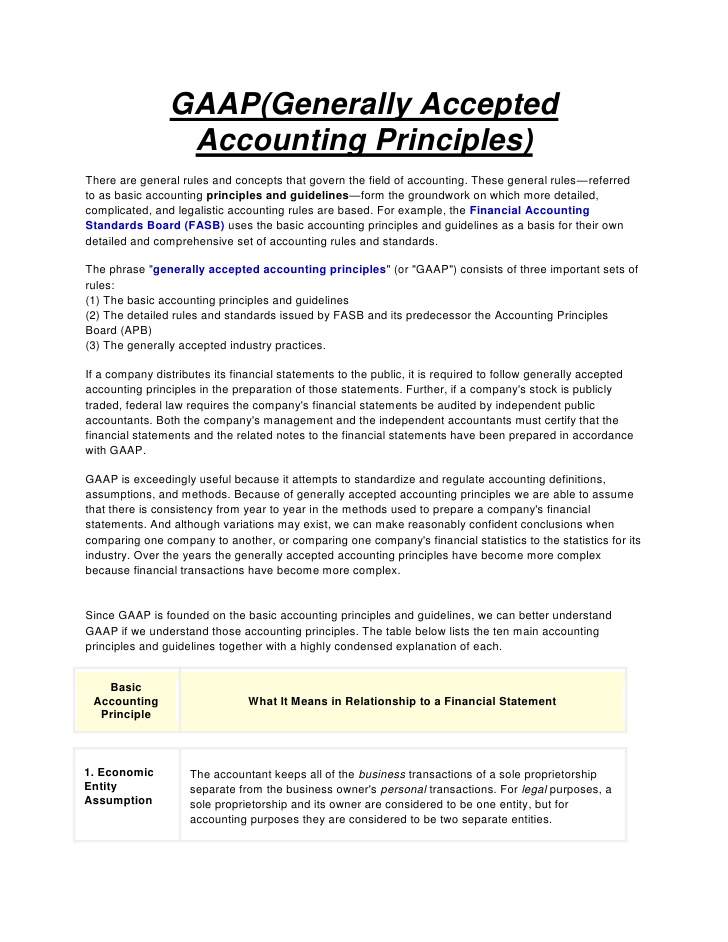

If everyone reported their financial information differently, it would be difficult to compare companies. Accounting principles set the rules for reporting financial information, so all companies can be compared uniformly. The principle of regularity dictates that bookkeeping practices should adhere to established rules and regulations. This means following standardized procedures and guidelines consistently to ensure that financial records are accurate and reliable. Compliance with legal and regulatory requirements is essential for maintaining the integrity of financial information.

- Therefore, most companies and organizations in the U.S. comply with GAAP, even though it is not a legal requirement.

- The principle of materiality recognizes that not all financial information is equally significant.

- It emphasizes recognizing expenses and liabilities as soon as they are foreseen, rather than waiting for certainty.

- GAAP is a set of detailed accounting guidelines and standards meant to ensure publicly traded U.S. companies are compiling and reporting clear and consistent financial information.

They are obligated to acquire this information from the business, which is why an accounting team’s requests may seem intensely thorough when requesting financial information. Matching Principle – states that all expenses must be matched non operating expenses and recorded with their respective revenues in the period that they were incurred instead of when they are paid. This principle works with the revenue recognition principle ensuring all revenue and expenses are recorded on the accrual basis. Historical Cost Principle – requires companies to record the purchase of goods, services, or capital assets at the price they paid for them. Assets are then remain on the balance sheet at their historical without being adjusted for fluctuations in market value. It’s important to have a basic understanding of these main accounting principles as you learn accounting.

Business

However, investors should be cautious with non-GAAP measures, as they can sometimes be used to present a misleading view of a company’s performance. Comparing financial statements across different companies—even within the same industry—becomes challenging without GAAP. Some companies may use GAAP and non-GAAP measures to report their financial results. GAAP regulations require that non-GAAP measures be identified in financial statements and other public disclosures, such as press releases. Accountants must, to the best of their abilities, fully and clearly disclose all the available financial data of the company.

To that end, we have built a network of industry professionals across higher education to review our content and ensure we are providing the most helpful information to our readers. There are various methods for calculating depreciation, such as straight-line depreciation and declining balance depreciation. Deferral entries are made when cash is received or paid before the revenue is earned or the expense is incurred.

In bookkeeping, you have to record each financial transaction in the accounting journal that falls into one of these three categories. At the end of the appropriate period, the accountant takes over and analyzes, reviews, interprets and reports financial information for the business firm. The accountant also prepares year-end financial statements and the proper accounts for the firm. The year-end reports prepared by the accountant have to adhere to the standards established by the Financial Accounting Standards Board (FASB). Very small businesses may choose a simple bookkeeping system that records each financial transaction in much the same manner as a checkbook. Businesses that have more complex financial transactions usually choose to use the double-entry accounting process.

How to Start a Bookkeeping Business in…

Since much of the world uses the IFRS standard, a convergence to IFRS could benefit international corporations and investors alike. For instance, GAAP allows companies to use either first in, first out (FIFO) or last in, first out (LIFO) as an inventory cost method. However, the FASB and the IASB continue to work together to issue similar regulations on certain topics as accounting issues arise. The International Accounting Standards Board (IASB) issues International Financial Reporting Standards (IFRS). These standards are used in approximately 168 jurisdictions, audit procedures for statistical sampling of inventory including those in the European Union (EU).

Key Principles of GAAP

Hiring a professional accounting team trained in GAAP and having internal auditors track and check finances are two ways to ensure your company is meeting GAAP standards. The principle of non-compensation prohibits offsetting debts against assets or expenses against revenues unless specifically permitted by accounting standards. This principle ensures that financial statements provide a clear and unbiased view of a company’s financial position. Generally accepted accounting principles (GAAP) comprise a set of accounting rules and procedures used in standardized financial reporting practices.

Business owners can use this data to assess the profitability of their operations, identify areas for improvement, and make strategic decisions to drive growth. Financial statements must be prepared in a way that follows and meets GAAP standards. Although exact GAAP requirements may vary depending on the industry, it is necessary to adhere to the principles at all times. You also need to ensure that all transactions concerning these three are correctly recorded in the right journal or document.